Custom Private Equity Asset Managers - An Overview

Wiki Article

Not known Facts About Custom Private Equity Asset Managers

(PE): spending in firms that are not publicly traded. About $11 (https://custom-private-equity-asset-managers.jimdosite.com/). There might be a few things you do not comprehend regarding the market.

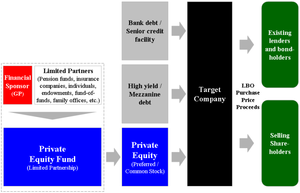

Partners at PE firms raise funds and manage the money to yield beneficial returns for investors, typically with an financial investment perspective of between four and seven years. Personal equity firms have a variety of financial investment choices. Some are rigorous sponsors or easy capitalists entirely reliant on monitoring to expand the firm and generate returns.

Since the most effective gravitate toward the bigger offers, the middle market is a significantly underserved market. There are a lot more vendors than there are very seasoned and well-positioned finance professionals with extensive buyer networks and sources to handle a bargain. The returns of exclusive equity are normally seen after a couple of years.

Some Known Details About Custom Private Equity Asset Managers

Flying listed below the radar of huge international corporations, a number of these little firms often give higher-quality customer care and/or specific niche items and services that are not being supplied by the big conglomerates (https://www.anyflip.com/homepage/hubrh#About). Such benefits draw in the rate of interest of private equity companies, as they have the insights and smart to make use of such chances and take the business to the following level

Personal equity capitalists must have dependable, capable, and reliable administration in position. Most managers at portfolio business are offered equity and reward compensation structures that award them for hitting their monetary targets. Such alignment of objectives is usually called for before an offer obtains done. Personal equity opportunities are typically out of reach for people that can't invest numerous dollars, but they should not be.

There are guidelines, such as restrictions on the aggregate amount of money and on the number of non-accredited capitalists (TX Trusted Private Equity Company).

try this siteSome Ideas on Custom Private Equity Asset Managers You Need To Know

Another drawback is the lack of liquidity; once in a personal equity purchase, it is not very easy to obtain out of or market. With funds under administration currently in the trillions, personal equity companies have become eye-catching financial investment automobiles for wealthy people and institutions.

For decades, the characteristics of exclusive equity have made the property class an appealing proposal for those who could get involved. Now that access to exclusive equity is opening as much as more specific investors, the untapped potential is ending up being a fact. The inquiry to take into consideration is: why should you invest? We'll begin with the primary arguments for buying exclusive equity: Exactly how and why personal equity returns have actually traditionally been greater than other possessions on a variety of degrees, How including private equity in a portfolio impacts the risk-return profile, by assisting to branch out versus market and intermittent risk, Then, we will detail some key factors to consider and dangers for exclusive equity investors.

When it involves presenting a new asset right into a portfolio, one of the most basic factor to consider is the risk-return account of that property. Historically, exclusive equity has exhibited returns similar to that of Arising Market Equities and greater than all various other typical possession classes. Its reasonably reduced volatility combined with its high returns makes for an engaging risk-return profile.

The Of Custom Private Equity Asset Managers

As a matter of fact, exclusive equity fund quartiles have the widest series of returns across all different possession classes - as you can see below. Methodology: Inner rate of return (IRR) spreads out determined for funds within classic years independently and after that averaged out. Typical IRR was determined bytaking the standard of the mean IRR for funds within each vintage year.

The takeaway is that fund option is critical. At Moonfare, we bring out a strict option and due persistance process for all funds detailed on the platform. The result of adding private equity into a portfolio is - as always - based on the profile itself. Nevertheless, a Pantheon research study from 2015 suggested that including exclusive equity in a profile of pure public equity can open 3.

On the other hand, the very best private equity firms have access to an also bigger swimming pool of unidentified opportunities that do not deal with the exact same analysis, as well as the resources to do due persistance on them and identify which are worth buying (Private Asset Managers in Texas). Investing at the very beginning implies greater risk, however for the business that do be successful, the fund benefits from higher returns

The Main Principles Of Custom Private Equity Asset Managers

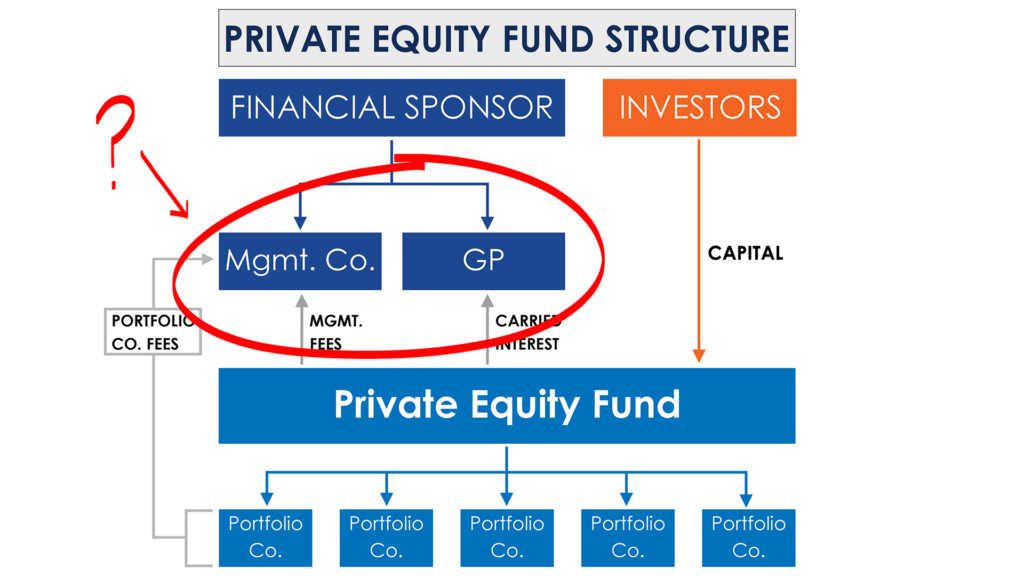

Both public and personal equity fund supervisors dedicate to spending a percent of the fund however there continues to be a well-trodden concern with straightening interests for public equity fund management: the 'principal-agent problem'. When an investor (the 'principal') hires a public fund manager to take control of their capital (as an 'agent') they delegate control to the manager while maintaining ownership of the properties.

In the case of exclusive equity, the General Partner doesn't simply gain a monitoring charge. Personal equity funds also mitigate another form of principal-agent issue.

A public equity capitalist inevitably wants one thing - for the administration to boost the stock price and/or pay out rewards. The financier has little to no control over the choice. We showed above the number of private equity strategies - specifically majority acquistions - take control of the operating of the business, making certain that the long-term worth of the firm precedes, rising the roi over the life of the fund.

Report this wiki page